Rental reimbursement insurance is designed to cover the cost of renting a car following an at-fault accident or another type of covered claim. It’s important to note, however, that while you may have rental reimbursement coverage as part of your policy, it likely doesn’t cover your rental car costs in all circumstances. For example, if your car breaks down due to a mechanical defect or breakage, rental reimbursement will not help to pay for a rental. Show

In order to be covered, it typically needs to be part of an accident claim or a claim for another covered event. It’s important to understand this distinction, as knowing what your auto insurance policy covers and does not cover under rental reimbursement coverage may help you determine your insurance needs. This information can come in handy if unexpected issues come up, like your car ending up unusable after an incident. How does rental reimbursement work?Rental reimbursement works like other claims filed with your insurance company. When you file a claim for rental reimbursement, your insurer will extend coverage up to your coverage limits. With rental reimbursement, your coverage could be a total amount, like $900, or a set amount of $30 a day, and up to $900 total. There are different coverage limits for rental reimbursement, so reviewing your coverage options with your insurance agent or company is best. Here’s how rental reimbursement works:

When does car insurance cover rental costs?Car insurance will cover rental costs after a qualifying claim is filed and approved. In these cases, you must already have rental reimbursement on your policy prior to the accident for there to be coverage. If you are not at fault, the other driver’s property damage liability insurance will pay for your rental car while your vehicle is under repair.

Rental car reimbursement coverage from your insurance company will only cover your rental costs after a covered loss. It will not cover you if your car has suffered a mechanical breakdown or if you are taking a personal or business trip and need a car while you’re away. Does car insurance include rental reimbursement coverage?Rental reimbursement coverage is not standard in many car insurance policies, but many insurance providers offer it as add-on coverage. Many insurance professionals recommend that drivers consider adding it as its price usually does not impact the cost of your car insurance policy by very much. Like all auto insurance coverage types, rental reimbursement or loss of use coverage comes with limits. Usually, you will see these listed in your policy as a per-day and per-incident cap. You might get up to $30 a day and up to $900 total, for example. Rental car reimbursement vs. other optional coverage typesTo better understand rental reimbursement and loss of use coverage, it may be beneficial to differentiate the two from other similar-sounding or similar-functioning coverage types.

Do you need rental reimbursement coverage if you are not at fault in an accident?If you are left without a vehicle because of an accident another person caused, their property damage liability insurance should step in to cover the cost of your rental car. Generally, this coverage will pay for a reasonable replacement, meaning it may cover a vehicle similar to the one you own. And usually, you will continue getting rental car coverage from the at-fault driver’s policy until your car is repaired or if your vehicle was totaled, until you paid for your vehicle. However, since determining fault in an accident can take time, most insurance experts recommend purchasing your own rental reimbursement coverage. If someone else is at fault in an accident, you can use your own coverage immediately and then have your insurance company recover the cost for the rental car from the at-fault party or their insurance company once the fault has been determined. When does car insurance not cover rental car expenses?There are some instances when you may not be able to lean on your rental reimbursement coverage for your rental costs. For example, you may have two vehicles listed on your policy: a car and a truck. If only the car has rental reimbursement coverage, but the truck is in an at-fault accident that requires a rental, your rental reimbursement coverage would not apply. Some other cases where rental car expenses are not covered include:

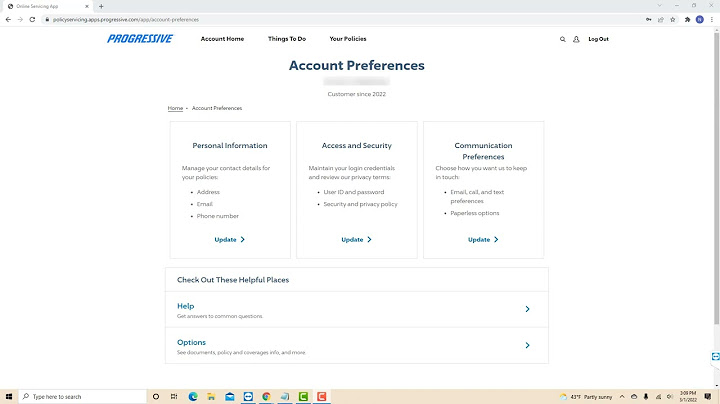

In sum, rental reimbursement coverage is an add-on that can pay for a rental if you add it to your policy and then experience a covered loss. But it has its limits, so policyholders cannot expect it to pay for all rental scenarios. In cases where you are in an accident and not at fault, you may receive coverage for a rental from the at-fault driver’s insurer, but the process could take time. If you only have one vehicle, most insurance experts recommend rental reimbursement coverage due to the low cost and peace of mind it can provide. Frequently asked questionsDoes progressive work with enterprise?When you're ready to go, Enterprise makes it easy with great cars and great deals. Plus, you get a special discount through Progressive.

Does progressive cover cars rented on Turo?Progressive, Geico and State Farm agents all told us they will not insure vehicles for car sharing services, such as Turo. Even Liberty Mutual, which provides Turo's own corporate policy, doesn't allow sharing on personal insurance but can on some business policies.

|

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 boxhindi Inc.